reposted from pebblewriter.com...

For those not incorporating harmonics into their trading strategy, I can only imagine how utterly confusing the market's last drop must have been. In fact, the entire past six weeks have been a market maker’s dream — constant whipsawing that would have been impossible to anticipate based on earnings, economic data or the advice of the financial media's talking heads.

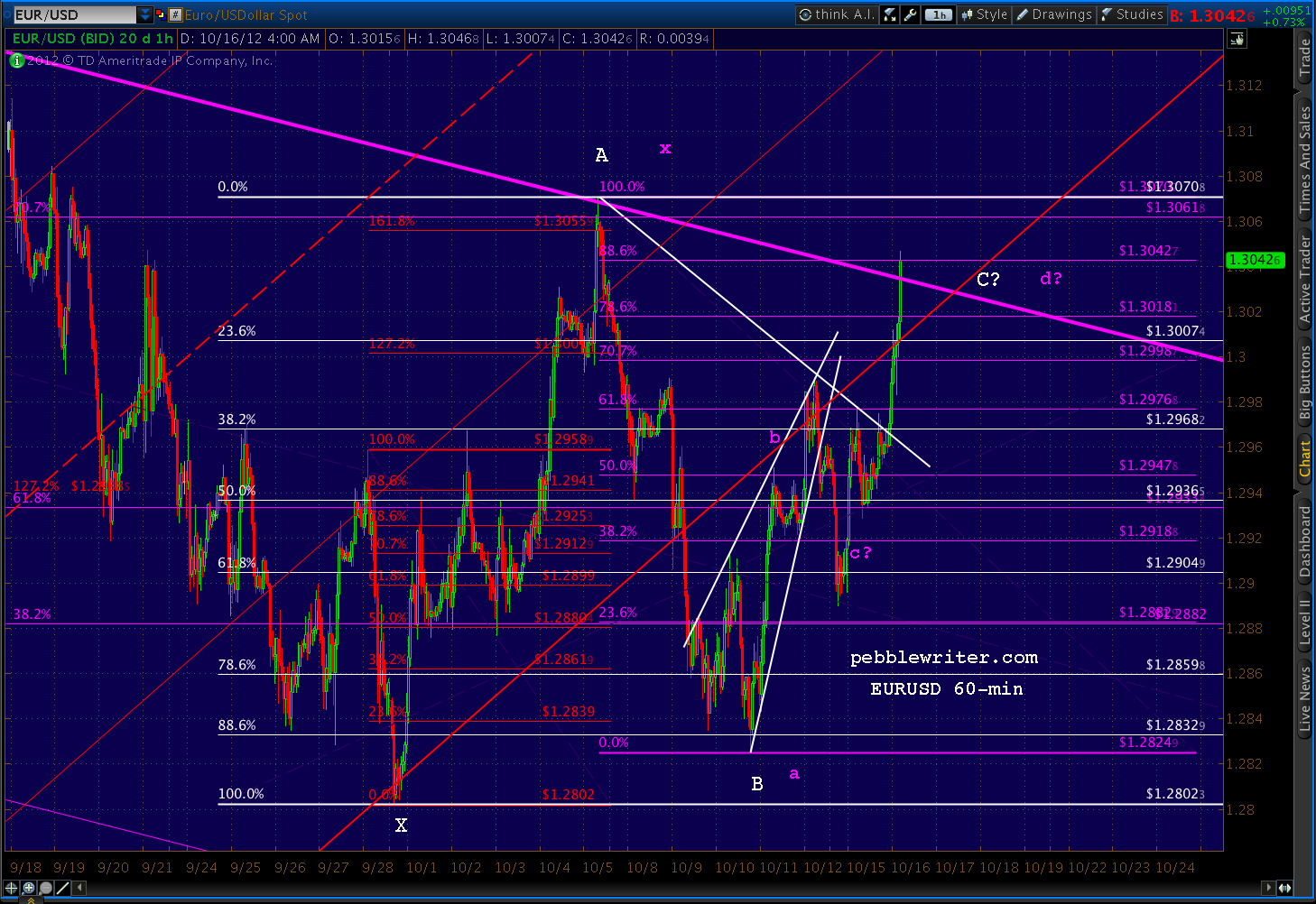

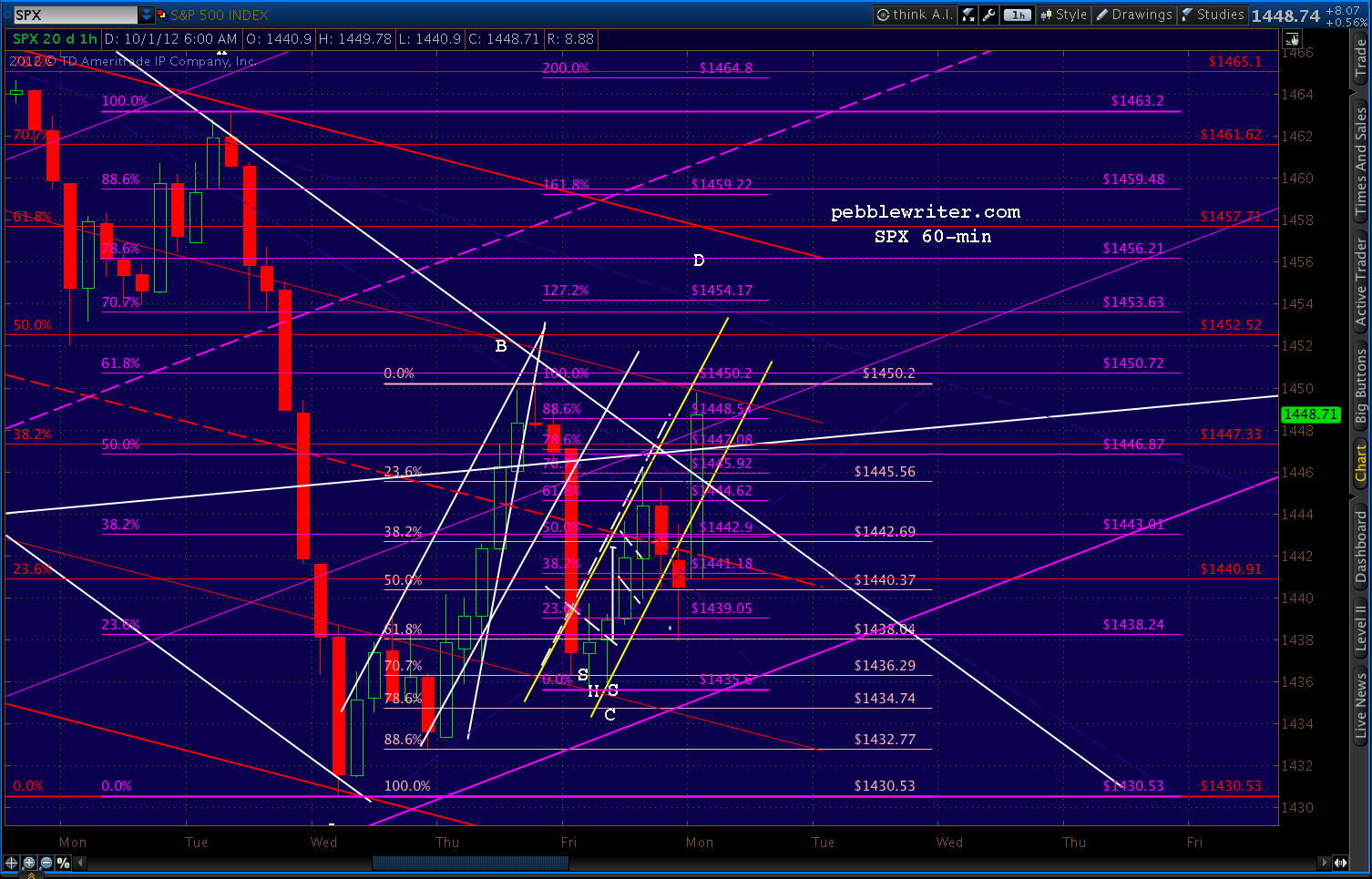

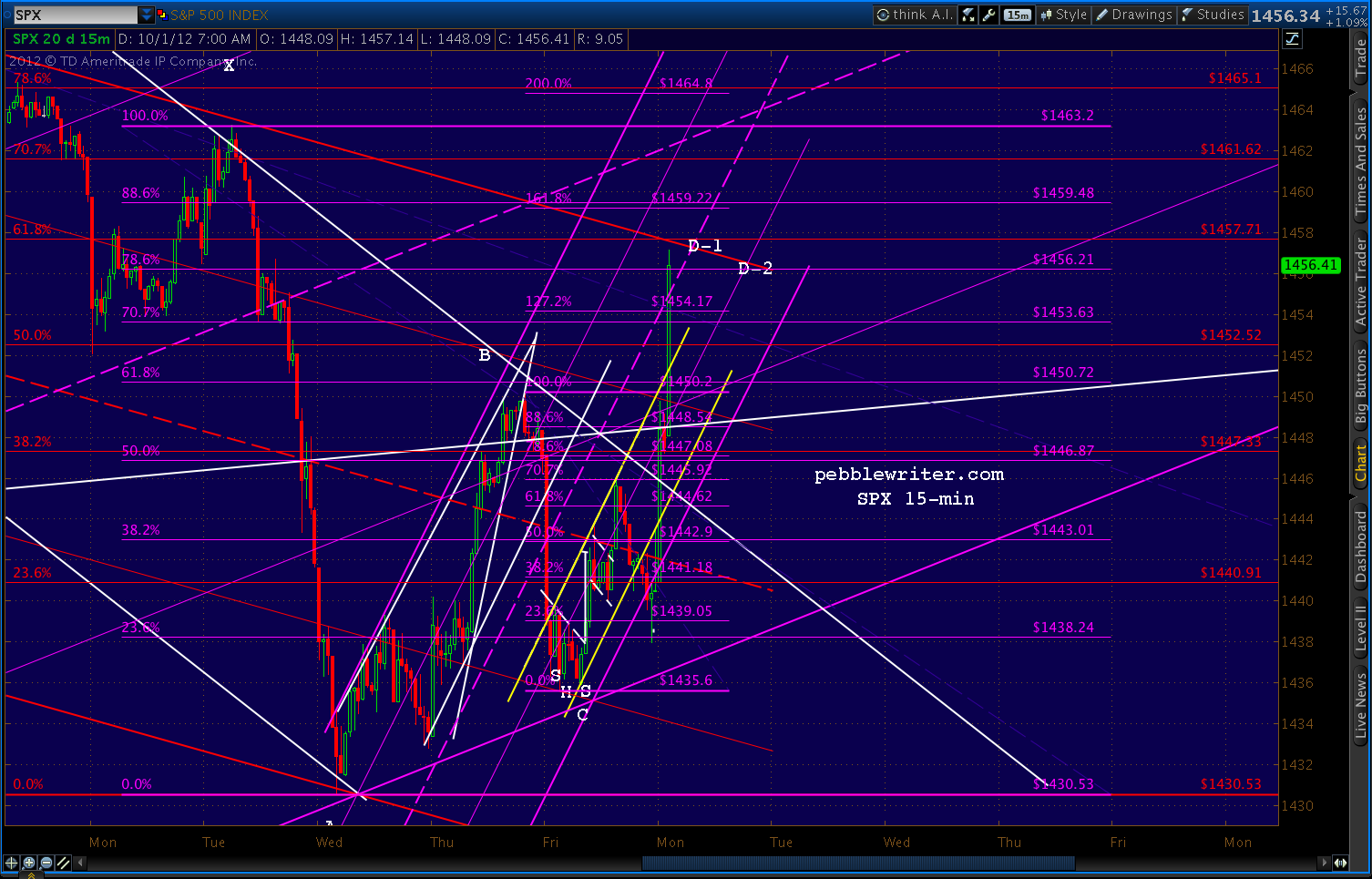

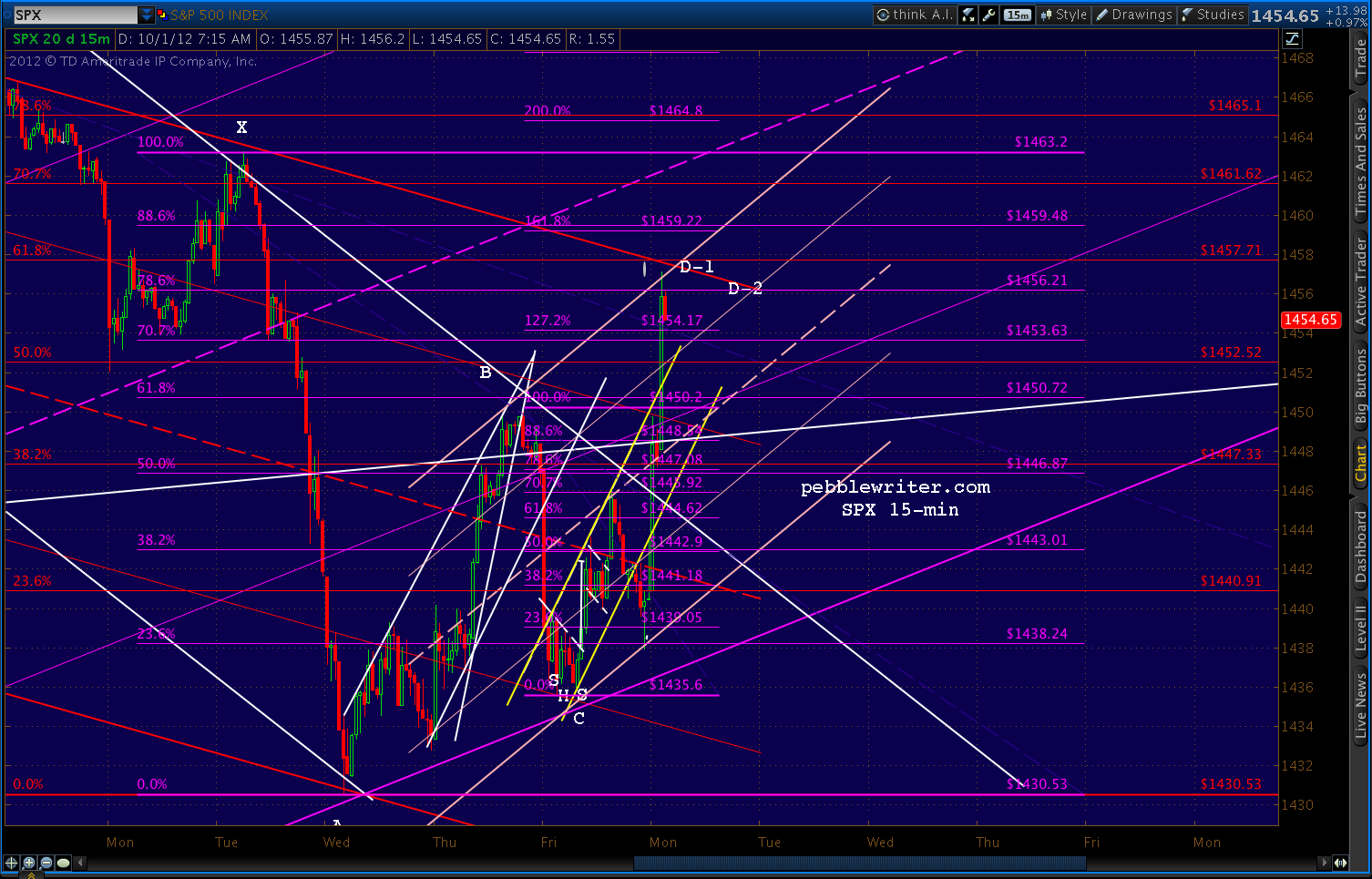

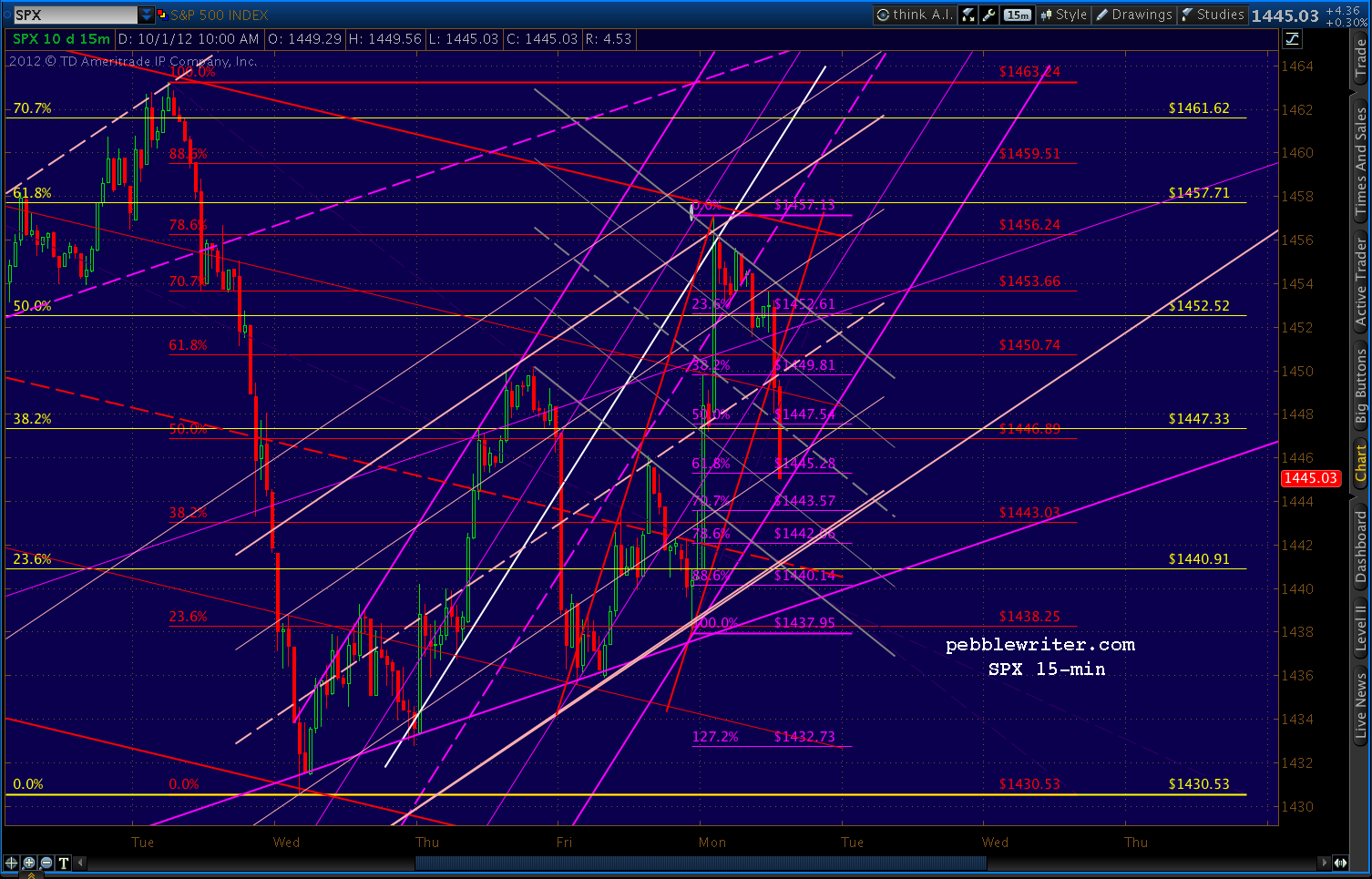

Seen through the prism of harmonics patterns, the reversal at 1474 was simply a Bat Pattern completion that paid off the 1576 – 666 drop between 2007 and 2009 [see: The World According to Ben]. And, every reversal since then has followed the rules of ordinary harmonic patterns — with an occasional assist from chart patterns (mostly channels.)

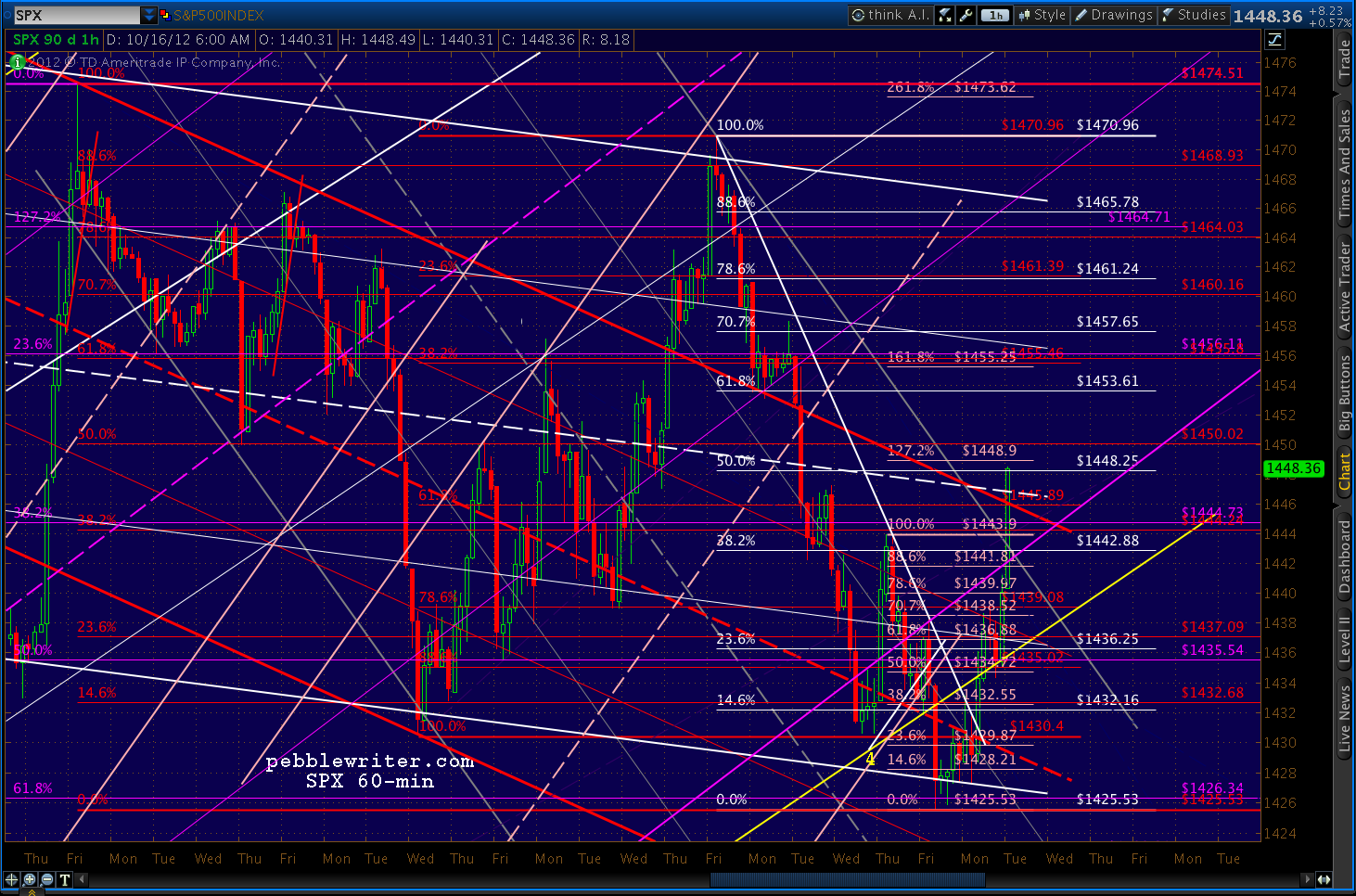

As can be seen from the chart below, the initial drop from 1474 to 1430 was a Bat Pattern retracement and channel line tag. It, in turn, set up a Bat Pattern (in purple) that signaled a reversal at 1469.50 (came at 1470.96) and established a declining channel (in white.)

The next move down was to the bottom of the new channel and a .618 retracement of the 1396-1474 rally. It was followed by another Bat Pattern (in green) targeting a reversal at 1465.78 (came at 1464.02.)

The final move down was initially to the white channel bottom, but pushed through to complete a Bat Pattern .886 retracement of the 1396 to 1474 move, as well as a Crab Pattern (1.618 extension) of the 1430 to 1470 move.

By reaching 1405.45, it also solidified the upside case originally discussed back on the 17th [see: Charts I'm Watching - Oct 17, 2012.]

In hindsight, the harmonics and chart patterns have done an outstanding job of showing us the way — even though there were times when the direction suggested made no sense at all. I'm almost certain that any unsuccessful trades I’ve made in the past six weeks were the result of “knowing better” than the charts and ignoring their signals.

The question now is whether reaching our 1405 target really suggests a move to 1500+, or is it merely setting the stage for a massive bull trap?

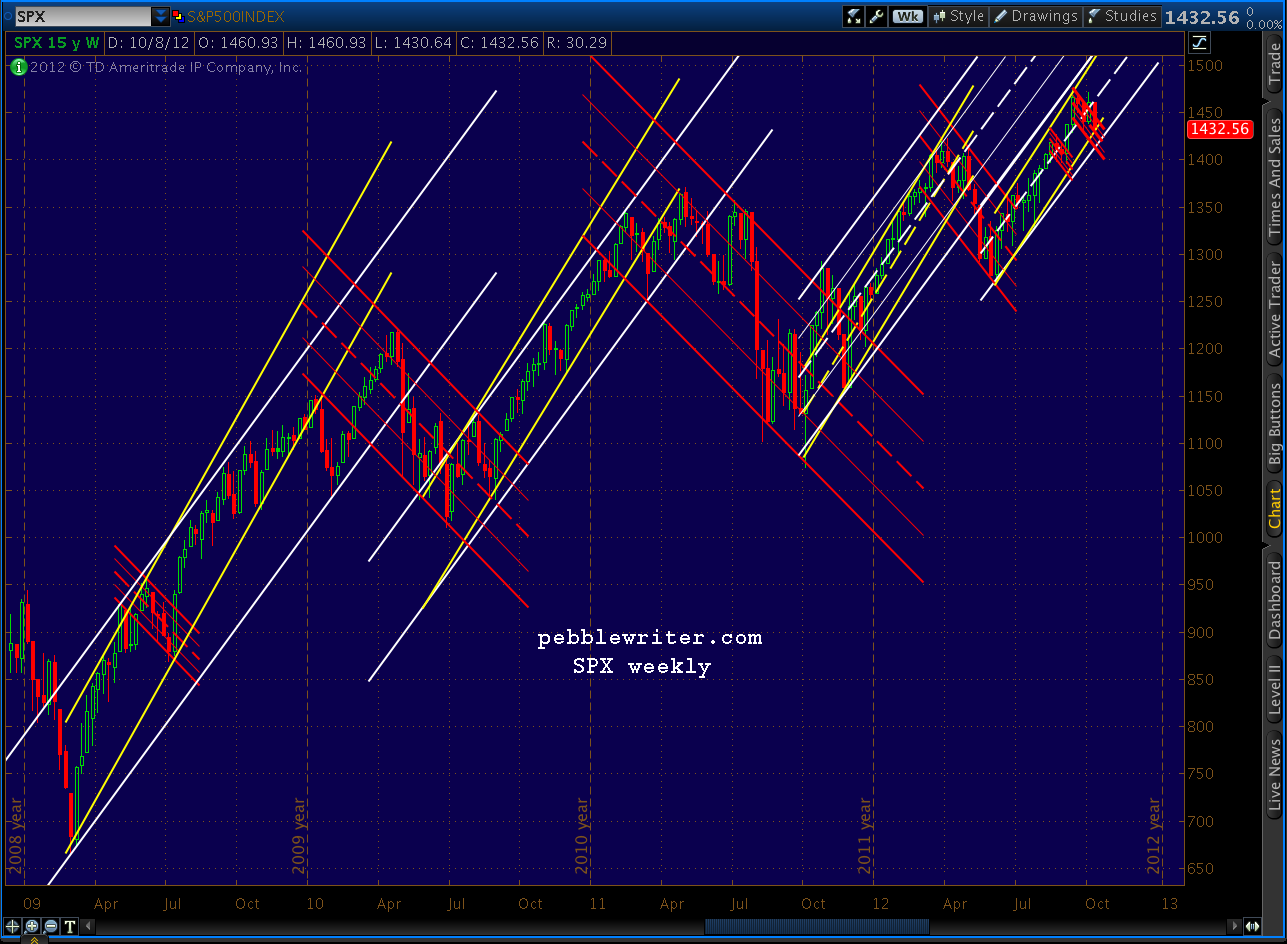

For help, I’m turning to an analog I think looks very promising. We have done very well with these in the past [see: Why Analogs Work.] The 2011 as 2007/8 analog knocked the cover off the ball last summer. And, the latest took us from 1422 down to 1266 and back to 1474 in spectacular style — earning us 60%+ returns over those six months.

For those not incorporating harmonics into their trading strategy, I can only imagine how utterly confusing the market's last drop must have been. In fact, the entire past six weeks have been a market maker’s dream — constant whipsawing that would have been impossible to anticipate based on earnings, economic data or the advice of the financial media's talking heads.

Seen through the prism of harmonics patterns, the reversal at 1474 was simply a Bat Pattern completion that paid off the 1576 – 666 drop between 2007 and 2009 [see: The World According to Ben]. And, every reversal since then has followed the rules of ordinary harmonic patterns — with an occasional assist from chart patterns (mostly channels.)

As can be seen from the chart below, the initial drop from 1474 to 1430 was a Bat Pattern retracement and channel line tag. It, in turn, set up a Bat Pattern (in purple) that signaled a reversal at 1469.50 (came at 1470.96) and established a declining channel (in white.)

The next move down was to the bottom of the new channel and a .618 retracement of the 1396-1474 rally. It was followed by another Bat Pattern (in green) targeting a reversal at 1465.78 (came at 1464.02.)

The final move down was initially to the white channel bottom, but pushed through to complete a Bat Pattern .886 retracement of the 1396 to 1474 move, as well as a Crab Pattern (1.618 extension) of the 1430 to 1470 move.

By reaching 1405.45, it also solidified the upside case originally discussed back on the 17th [see: Charts I'm Watching - Oct 17, 2012.]

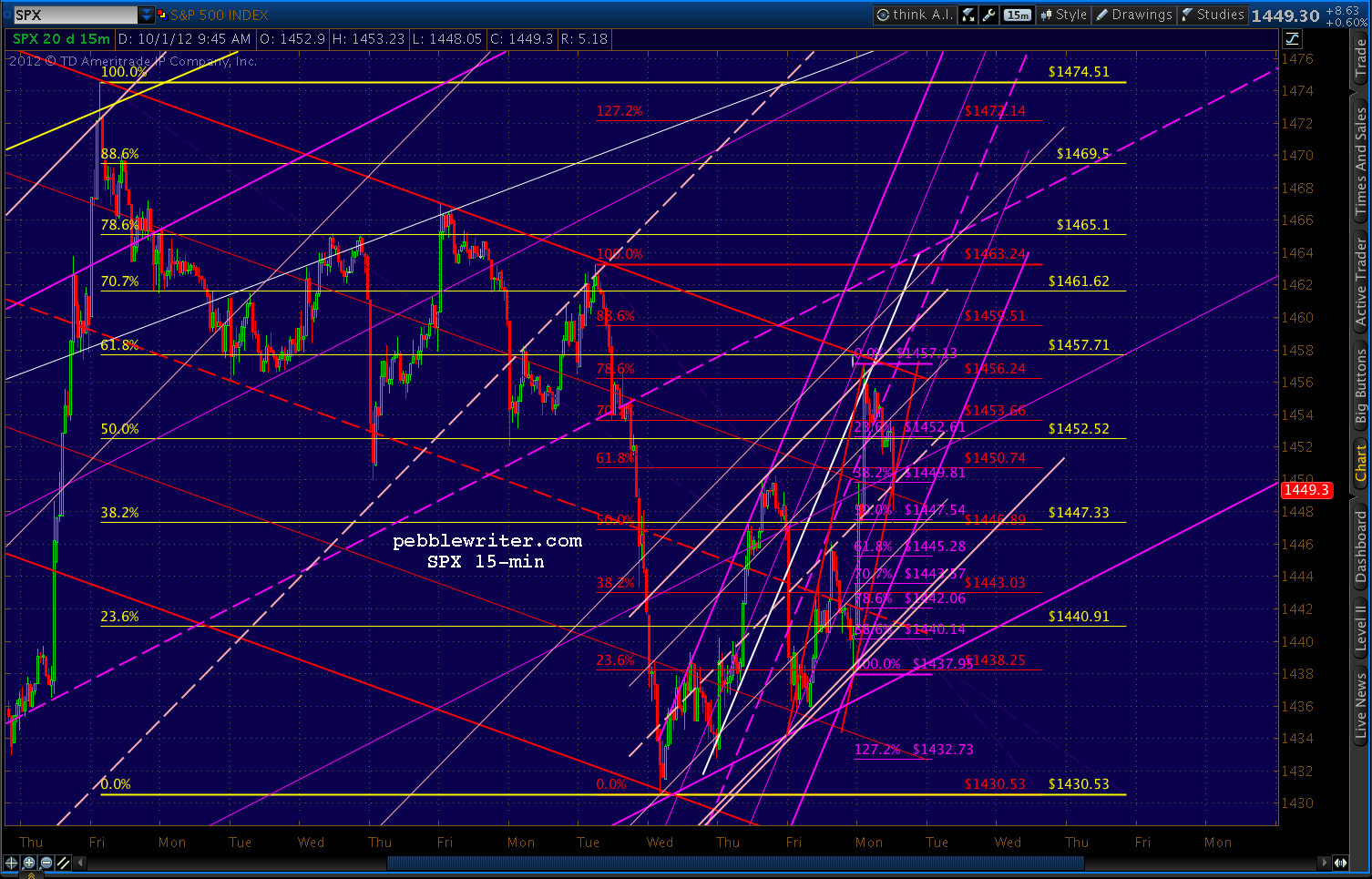

If 1474 was a normal wave 3 or wave 5 high, we would typically be open to a corrective wave of greater than a .618 retracement. Look what happens if we make it a .786 or .886 retracement. Suddenly, the yellow 1.618 lines up very nicely with the other 1.618′s up there at 1515-1518.In other words, a Crab Pattern with 1405 as its base instead of 1425 (the previous low) is consistent with the 1515 Crab Pattern target established by the 1347-1074 drop from July to October 2011, and the 1518 Crab Pattern target set up by the 1422-1266 drop from April to June 2012.

In hindsight, the harmonics and chart patterns have done an outstanding job of showing us the way — even though there were times when the direction suggested made no sense at all. I'm almost certain that any unsuccessful trades I’ve made in the past six weeks were the result of “knowing better” than the charts and ignoring their signals.

The question now is whether reaching our 1405 target really suggests a move to 1500+, or is it merely setting the stage for a massive bull trap?

For help, I’m turning to an analog I think looks very promising. We have done very well with these in the past [see: Why Analogs Work.] The 2011 as 2007/8 analog knocked the cover off the ball last summer. And, the latest took us from 1422 down to 1266 and back to 1474 in spectacular style — earning us 60%+ returns over those six months.

This new analog is important not just for

its capacity to protect investors from losses, but its potential for

nice gains for those who don’t mind speculating a bit.

continued at pebblewriter.com...